Employers in Hong Kong are required to report employee earnings to the Inland Revenue Department (IRD). Failing to do so accurately can lead to penalties. The BIR56A form is one of the core documents involved in this process.

This section explains what the BIR56A form is, why it matters, and which companies are responsible for submitting it.

Definition and Purpose of the BIR56A Form

The IR56A is an employer’s return form used to report an employee’s income to the IRD for tax assessment purposes. It serves as the official notification that summarizes employment details for a given tax year.

The form itself is a cover sheet. It must be submitted together with IR56B forms, which provide individual salary details for each employee.

Who Is Required to File BIR56A?

The IR56A form must be completed by any company or business that employs staff in Hong Kong, regardless of size or sector. This includes:

-

Private companies with full-time or part-time staff

-

Public organizations and statutory bodies

-

Non-profit associations with salaried employees

-

Overseas companies employing staff based in Hong Kong

Freelancers and independent contractors are not usually covered under this form unless they're considered employees under Inland Revenue rules.

What Triggers the Filing Obligation?

Employers must file an BIR56A annually, typically around the beginning of April. However, separate forms may also be required when:

-

An employee leaves the company

-

An employee plans to leave Hong Kong

-

A new employee joins during the year

These cases may involve filing additional forms like IR56F or IR56G.

The IR56A form is a mandatory document for reporting staff income to the IRD. Employers must ensure it's filed correctly and on time, along with supporting forms such as the IR56B. Understanding your obligation under Hong Kong tax law helps prevent administrative errors and possible fines.

Key Deadlines for Submitting BIR56A in Hong Kong

Missing a tax deadline can create serious problems for employers. When it comes to the IR56A, knowing the right time to file is just as important as knowing how.

This section outlines the main filing deadlines for IR56A and highlights the situations where additional forms may be needed.

Annual Submission Deadline

Each year, the Inland Revenue Department (IRD) sends out an Employer’s Return—known as the BIR56A—around early April. When this notice arrives, employers must submit the following within one month:

-

The IR56A form (the cover page)

-

All related IR56B forms for employees

If you don’t receive the BIR56A by mid-April, you're still responsible for notifying the IRD. The deadline doesn’t change.

Situations That Trigger Additional Deadlines

Apart from the annual filing, employers must also submit forms under specific employment changes. These have their own deadlines:

-

Employee leaves the company

Submit the IR56F form no later than one month before the date of termination. -

Employee plans to leave Hong Kong

Submit the IR56G form at least one month before their departure date. You must also withhold final payments until clearance is granted by the IRD. -

New employee joins during the year

While this doesn’t trigger an immediate filing obligation, the individual’s income must still be reported in the annual IR56B submission.

Extensions and Late Submissions

The IRD may grant an extension upon request, but the request should be made in writing before the due date. Late filings can result in penalties, audits, or loss of compliance status for the company.

Summary

Employers must submit the IR56A and IR56B forms within one month of receiving the annual Employer’s Return notice from the IRD. Special events—like staff departures or overseas moves—come with their own fixed deadlines. Planning ahead ensures you stay compliant and avoid unnecessary trouble with tax authorities.

Step-by-Step Guide to Completing the IR56A Form

Filing the IR56A incorrectly can delay tax processing and lead to follow-up requests from the Inland Revenue Department. That’s why accuracy—and knowing what each part of the form means—is key.

This section breaks down how to complete the IR56A form correctly, with clear steps and practical examples.

Step 1: Download the Form from the IRD Website

Start by downloading the latest version of the IR56A from the Inland Revenue Department's official website. Always use the most current form, as older versions may no longer be accepted.

Step 2: Fill in Employer Details

The top section asks for information about your company. This includes:

-

Employer’s file number (as stated in the BIR56A)

-

Business registration number

-

Company name, address, and telephone number

-

Type of business (e.g., trading, consulting, services)

Double-check these fields to ensure they match your business registration certificate.

Step 3: Confirm Tax Year and Signature

Enter the relevant assessment year—for example, 2023/24—and tick the box confirming the type of IR56 forms submitted (usually IR56B). Then, fill in:

-

The name of the signing officer

-

Their position (e.g., Director or HR Manager)

-

Date of signing

The form must be signed by someone authorized to represent the employer.

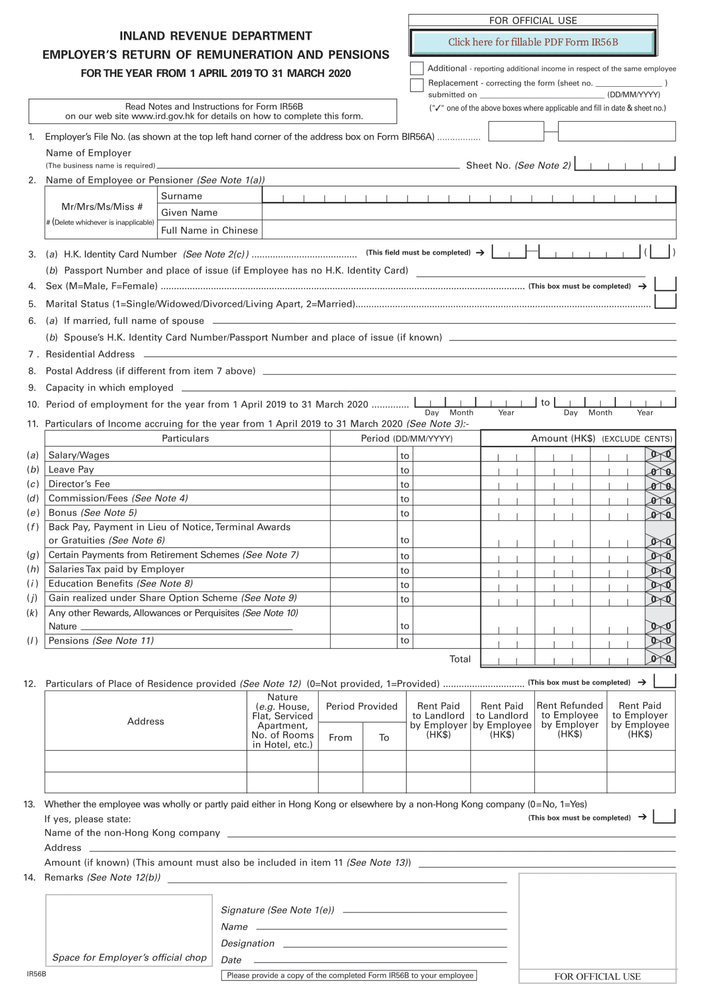

Step 4: Prepare the IR56B Forms for Each Employee

Each IR56A must be submitted with a set of IR56B forms. These list individual employee income details. Make sure the number of IR56B forms matches the number entered on the IR56A summary.

Typical fields on the IR56B include:

-

Employee’s full name and HKID

-

Position held and employment period

-

Total income paid during the year

-

Allowances, bonuses, and housing benefits

Accuracy in these supporting forms is just as important as the cover sheet.

Step 5: Submit the Forms to the IRD

You can submit the IR56A and all IR56Bs in either of the following ways:

-

By paper: Send to the IRD’s address with all required forms enclosed.

-

Electronically: Use the e-Filing service through eTAX or the IRD’s ER e-Filing software.

Online filing is generally faster and provides confirmation of receipt.

Completing the IR56A involves more than just filling in a form—it’s a process of gathering accurate employee data, checking employer information, and ensuring timely submission. Following each step carefully helps you stay compliant and avoid unnecessary delays from the tax office.

What Information Employers Must Include in IR56A

Filing the IR56A isn’t just about ticking boxes. Each field serves a legal and reporting function, and incomplete or incorrect data can result in processing delays—or worse, compliance issues.

This section explains exactly what details need to be filled in and why each part matters.

Basic Employer Identification

At the top of the form, employers must enter identifying business information. These fields verify that the submission is tied to the correct organization.

Key details include:

-

Employer’s file number (found on the Employer’s Return, BIR56A)

-

Business registration number (8-digit identifier issued by the Hong Kong Companies Registry)

-

Company name as registered

-

Postal address and contact telephone number

-

Nature of business (e.g., education, trading, logistics)

Employment Summary for the Year

This section provides the IRD with a snapshot of your staffing situation over the relevant tax year. It should reflect the number of people employed and reported.

Information required:

-

Total number of employees for whom IR56B forms are submitted

-

Whether any employees left or joined during the year

-

Confirmation of employees who departed Hong Kong

If employees left mid-year or relocated, additional forms (IR56F or IR56G) should also be submitted.

Declaration and Authorized Signature

At the bottom of the form, a declaration must be completed and signed by a responsible officer of the business. This is a legal confirmation that the information provided is true and complete.

The form asks for:

-

Full name of the signing officer

-

Position in the organization (e.g., Director, Manager)

-

Signature

-

Date of signing

Only individuals with the authority to act on behalf of the company should sign.

The IR56A collects key data about your business and its employees for the tax year. From company identifiers to employment headcounts and declaration details, each section supports accurate income tax assessment by the IRD. Careful attention to detail helps avoid unnecessary follow-up or penalties.

When to File IR56A: Termination, Resignation, and Departure Cases

Filing the annual IR56A form is only part of an employer’s tax duties. When an employee leaves the company—or the city—special rules apply. Missing these deadlines can lead to delays or penalties, especially if the employee is leaving Hong Kong permanently.

This section outlines what to file, and when, in cases of resignation, termination, or departure from Hong Kong.

Employee Resignation or Termination

When an employee’s service ends—whether they resign, are terminated, or their contract expires—you must submit an IR56F form. This informs the Inland Revenue Department of the end of employment.

Deadline:

The IR56F must be filed no later than one month before the termination date.

What to Include:

-

Last day of employment

-

Reason for leaving

-

Final payment details

-

Any unused leave paid out

This requirement applies even if the departure is friendly and the employee will stay in Hong Kong.

Employee Leaving Hong Kong

If the employee plans to depart Hong Kong for good or for an extended period, the employer must file IR56G.

Deadline:

Submit the IR56G at least one month before the departure date.

Additional Requirement:

You must withhold all payments (final salary, bonus, leave encashment) until the employee obtains a Letter of Releasefrom the IRD.

This helps the IRD ensure that any outstanding taxes are cleared before the employee leaves.

Special Note on Directors and Consultants

Even if someone is no longer actively working, if they still receive income as a director or consultant, the same filing obligations apply. Ending such an arrangement requires proper documentation through the IR56F or IR56G, depending on their departure plans.

What About the IR56A?

While the IR56F and IR56G forms are for specific events, the IR56A form still needs to be filed as part of the annual Employer’s Return. It must include all employees—current and past—who were on the payroll during the assessment year.

When an employee leaves the company or prepares to leave Hong Kong, timing matters. File the IR56F or IR56G forms within one month of the relevant event, and don’t release final payments for departing employees without proper clearance. These filings ensure compliance and protect both employer and employee during transitions.