Hong Kong continues to be a leading global financial hub, characterized by its robust financial infrastructure, free economy, and strategic location in Asia. In 2024, the financial sector in Hong Kong has shown resilience and adaptability amidst global economic uncertainties and regional challenges. This article provides an overview of the financial performance of key finance companies in Hong Kong, highlighting significant financial statistics and trends observed in 2024.

Financial Performance of Major Finance Companies

-

HSBC Holdings plc

- Revenue: HSBC reported a revenue of HKD 580 billion in 2024, reflecting a modest year-on-year increase of 4%.

- Net Profit: The net profit stood at HKD 130 billion, a significant increase from the previous year’s HKD 115 billion.

- Assets Under Management (AUM): The bank’s AUM reached HKD 12 trillion, maintaining its position as one of the largest banks in the world.

- Return on Equity (ROE): HSBC’s ROE improved to 8.5% from 7.8% in 2023, indicating better profitability and efficient use of equity.

-

Standard Chartered Bank (Hong Kong) Limited

- Revenue: Standard Chartered reported a revenue of HKD 200 billion, up by 3% compared to the previous year.

- Net Profit: The bank’s net profit increased to HKD 45 billion from HKD 40 billion in 2023.

- AUM: The AUM grew to HKD 4 trillion, supported by strong performance in wealth management and investment services.

- ROE: The ROE for 2024 was 9.2%, slightly higher than the 8.9% recorded in 2023.

-

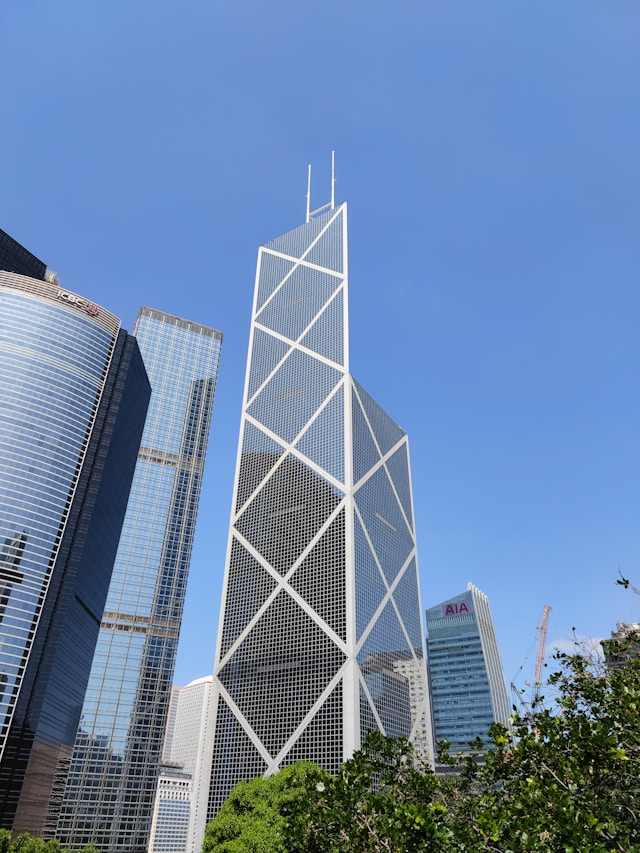

Bank of China (Hong Kong) Limited

- Revenue: Bank of China (Hong Kong) posted a revenue of HKD 350 billion, marking a 5% increase year-on-year.

- Net Profit: The net profit reached HKD 90 billion, up from HKD 85 billion in 2023.

- AUM: The bank’s AUM stood at HKD 8 trillion, driven by growth in both retail and corporate banking sectors.

- ROE: The ROE remained stable at 10%, reflecting strong profitability and financial stability.

-

Hang Seng Bank Limited

- Revenue: Hang Seng Bank reported a revenue of HKD 180 billion, up by 4% from the previous year.

- Net Profit: The net profit increased to HKD 50 billion from HKD 48 billion in 2023.

- AUM: The AUM was HKD 3 trillion, with significant contributions from its retail banking and wealth management segments.

- ROE: The ROE was 11%, consistent with the previous year’s performance.

-

DBS Bank (Hong Kong) Limited

- Revenue: DBS Bank’s revenue in Hong Kong was HKD 150 billion, showing a 6% increase year-on-year.

- Net Profit: The net profit rose to HKD 35 billion from HKD 32 billion in 2023.

- AUM: The bank’s AUM reached HKD 2.5 trillion, bolstered by strong growth in corporate banking and asset management.

- ROE: The ROE improved to 10.5% from 10% in the previous year.

Key Trends and Insights

-

Digital Transformation: The ongoing digital transformation continues to be a critical focus for Hong Kong’s finance companies. Investments in fintech, digital banking services, and AI-driven financial products have been significant, driving operational efficiency and enhancing customer experiences.

-

Sustainable Finance: There has been a notable shift towards sustainable finance, with many institutions increasing their green financing portfolios. ESG (Environmental, Social, and Governance) considerations are becoming integral to investment strategies, driven by both regulatory frameworks and investor demand.

-

Regional Expansion: Hong Kong finance companies are increasingly looking to expand their presence in the Greater Bay Area and other parts of Asia. This regional expansion is aimed at capturing new growth opportunities and diversifying revenue streams.

-

Regulatory Environment: The regulatory landscape remains dynamic, with ongoing updates to ensure financial stability and transparency. Compliance with international standards and local regulations is a priority for maintaining investor confidence and market integrity.

-

Economic Uncertainties: Despite strong financial performance, uncertainties such as global economic slowdowns, geopolitical tensions, and pandemic-related challenges continue to pose risks. Companies are adopting risk management strategies to mitigate these potential impacts.

Conclusion

Hong Kong’s finance companies have demonstrated resilience and robust performance in 2024, underpinned by strategic initiatives in digital transformation, sustainable finance, and regional expansion. As the global financial landscape evolves, Hong Kong’s financial sector remains well-positioned to navigate challenges and seize opportunities, maintaining its status as a leading international financial center.